Research

Performance Report: Subprime Auto, July 2025

26 August 2025

July Update: Older Borrowers Drive Auto Growth; Subprime Beats Seasonal Trend

Historically combined with our broader consumer credit report, our analysis of the auto sector will now be published independently, allowing us to deliver faster insights and expand coverage across origination and performance trends.

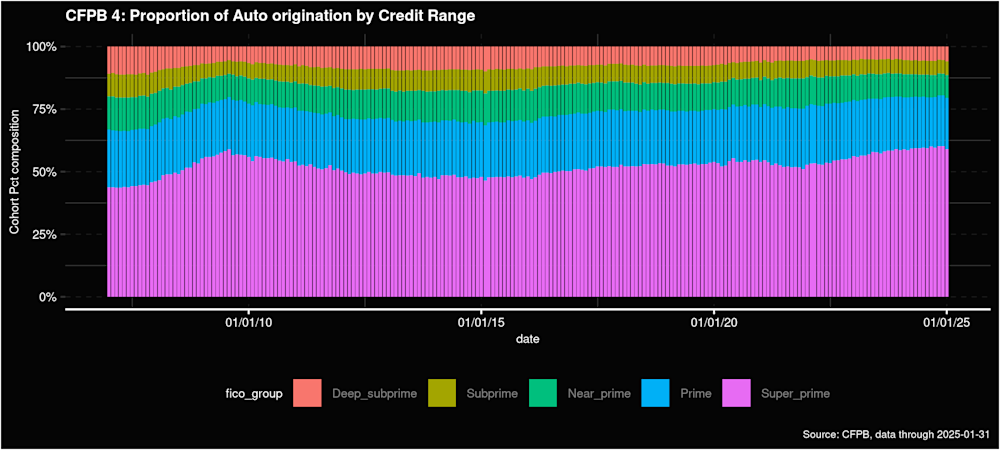

This first dedicated report also integrates CFPB auto loan data, providing a deeper view into borrower dynamics and origination mix alongside dv01’s Subprime Auto benchmarks.

Quick Insights

Older Borrowers Lead Growth: Auto originations to borrowers 65+ rose substantially, now 13% of today’s originations vs. 5% pre-GFC, while originations to borrowers under 30 remain flat at pre-COVID levels.

Prime & Super Prime Dominate: Over 80% of auto loans now fall in Prime/Super Prime, up from 65% historically, with Super Prime alone at 61%.

Subprime Auto Outperformance: In July, 30+ impairments fell 9 bps MoM, cure and payment rates improved, and charge-offs materially outperformed seasonal expectations.